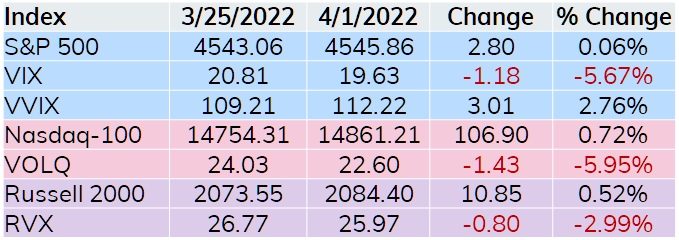

Things are getting relatively quiet as the S&P 500 was up only 0.06% on a week over week basis. Additionally, the high – low range for the S&P 500 was under 3% each of the past two weeks, the first time this has happened since November of last year.

Diminishing realized volatility is impacting volatility indices, pushing VIX below 20.00 for most of this past week. For context, VIX has not closed below 20.00 the majority of days during a week since January. A slight outlier in this space is VVIX, which remains elevated relative to historical norms. Also, VVIX was the only volatility index on the table above that rose last week. This is not unusual as VIX at lower levels may make VIX call pricing a bit more attractive so those options got a bit of an implied volatility bump last week.

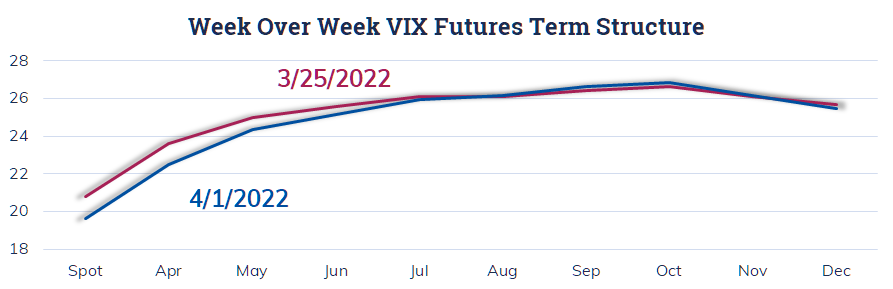

The VIX curve shifted lower, in almost a textbook like fashion on the short end. Do note that on the farther end of the curve some prices rose. Of specific interest is the October contract. Keep in mind that the October future will settle into pricing determined by November S&P 500 options and we have a significant election in the US during early November. Odds are that October bump will remain a bit elevated relative to other VIX futures markets based on some uncertainty associated with the US mid-term election.

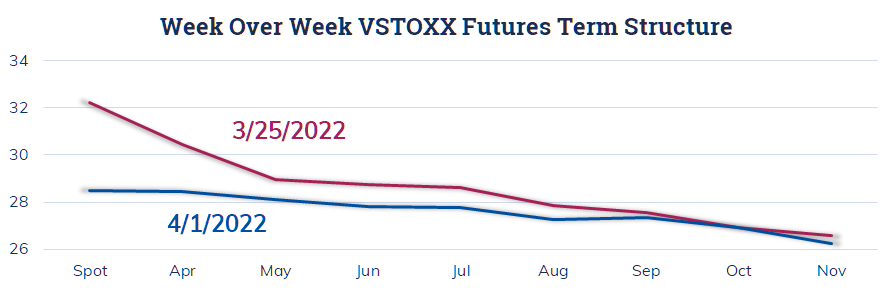

Turning to the VSTOXX curve, the shape is dramatically different when compared to the VIX curve. This is a function of another election, occurring in France next weekend. This is the first round of their national election with the second round coming on April 24. VSTOXX did drop last week, but a distinct backwardation in the VSTOXX curve persists and should stick around through next week as the April 10 election approaches.

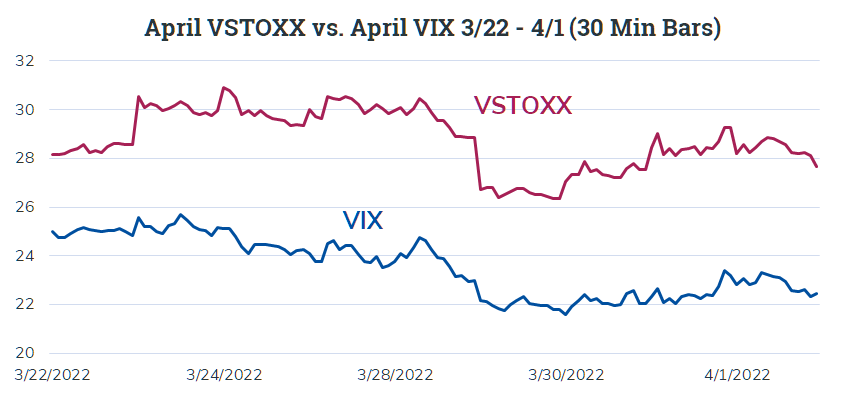

One way to play the lead up to this election is the spread between VIX and VSTOXX. I’ve been keeping an eye on the April contracts which will still have a little time to expiration before and after next weekend. The spread between April VSTOXX and VIX futures had been widening as time passes, but remained steady last week. The chart below shows 30-minutes bars during US market hours comparing April VSTOXX and VIX pricing.

A couple of weeks ago this spread had April VSTOXX at about a three point premium to VIX, this spread has widened to about six points and been pretty steady over the past week. My best guess is that the April VSTOXX will outperform VIX futures next week as the market adjusts a bit more to the extra risk associated with next weekend’s election.

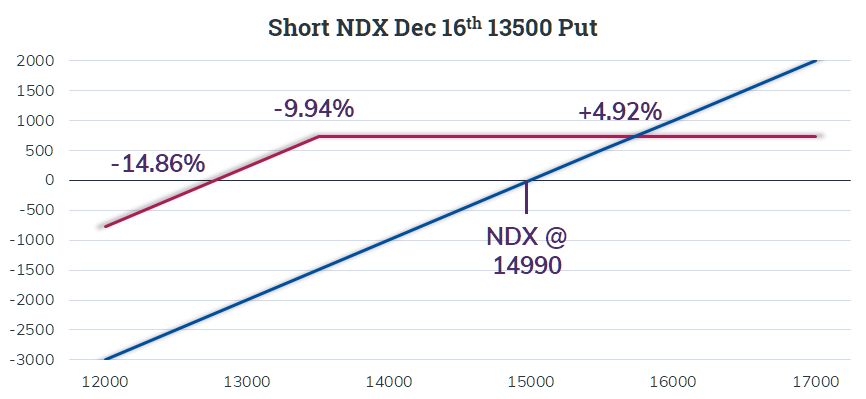

Thursday was the end of the first quarter 2022, which like everything else seemed to fly by quickly. I decided since the year is 25% in the books that I would search around for trades with a longer dated outlook than the majority of option trades hitting the tape. I did not have to search too hard to find an attractive on. Specifically, an NDX put option sale looking to standard December expiration. On Thursday, with NDX at about 14990 one trader came in selling the NDX Dec 16th 13500 Put for 737.00. The result at December expiration shows up below.

Based on the 737.00 premium and NDX at 14990, the return is 4.92% anywhere above 13500. Once NDX is up 4.92% from current levels, buying the index outperforms this short put trade. The short strike price, 13500, is 9.94% lower than where NDX was trading when the trade was executed. Finally, break-even for this short put trade is down at 12763, a drop of 14.86%. Selling puts can be a bit worrisome, but this trade has a nice buffer before worry would set in.