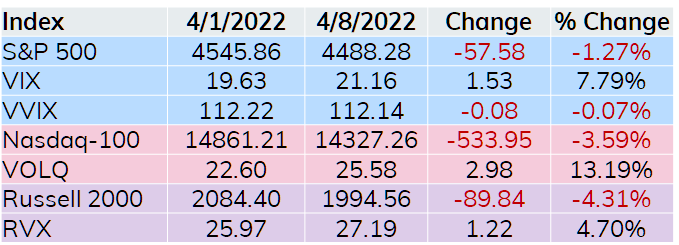

Concerns about the economy possibly falling into recession along with pending higher interest rates weighed on the U.S. equity markets last week. Small caps led the way lower as the Russell 2000 lost over 4%. Large cap stocks held up best with the S&P 500 dropping just over 1% on the week.

The three volatility indices that are directly related to broad based indices were higher with VOLQ leading the way rising almost 3 points. VVIX was basically unchanged on the week dropping 0.08.

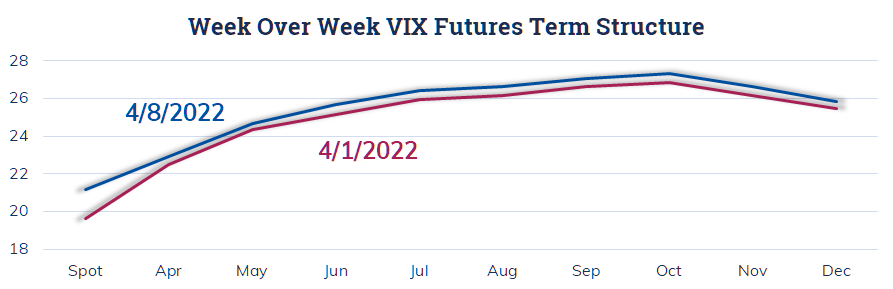

The VIX term structure rose in a very parallel fashion across all time frame. Like last week, October is trading at the highest level of any VIX future. This is a function of where traders think volatility expectations will be in October a few weeks before the November mid-term elections in the US.

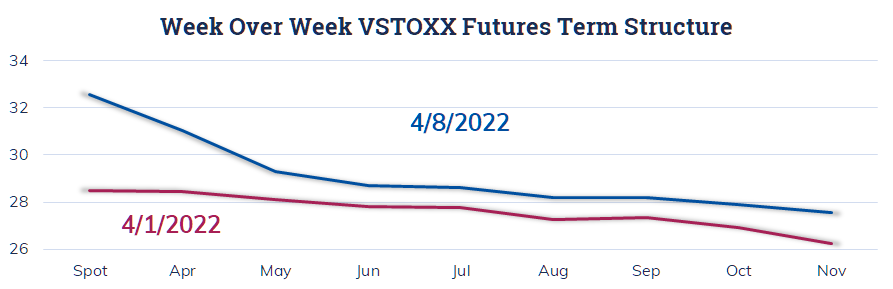

Speaking of elections, there is a major one in France this weekend as the first round of voting occurs on Sunday April 10. The result is that the VSTOXX term structure finished the week in more backwardation that it did for the previous week.

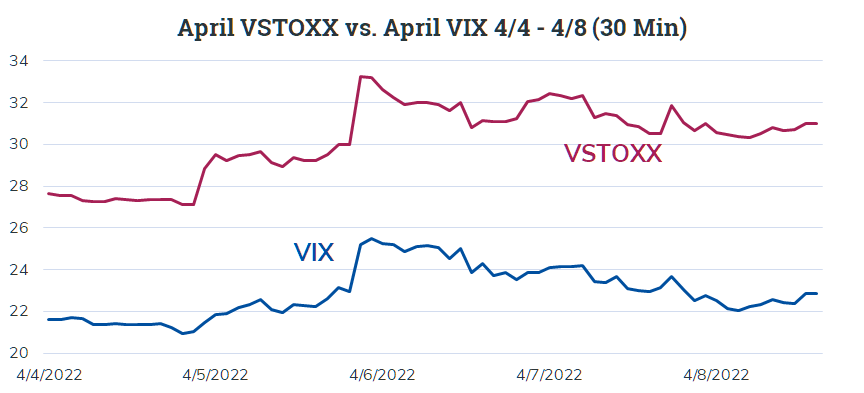

Based on history, the elevated VSTOXX levels will come in a bit after the first round results are announced. In addition to following the VSTOXX term structure, we’ve been watching the spread between April VSTOXX and VIX futures prices.

The week began with the April VSTOXX contract under a 6 point premium to VIX and finished with the VSTOXX contract at over a 7 point premium. Finally, an interesting twist for the 2022 French election is that the second round occurs after April expiration, so our attention will move to the May contracts on Monday with respect to election results.

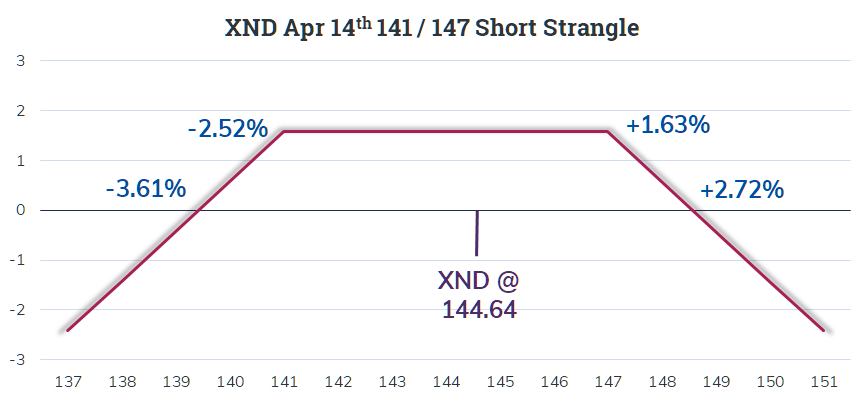

Elevated volatility creates option selling opportunities and on Friday a trader used Nasdaq-100 Micro Index (XND) options to take advantage of this. With XND at 144.64 (NDX equivalent = 14464) a trader sold 200 XND Apr 14th 141 Puts for 0.77 and the same number of XND Apr 14th 147 Calls for 0.81 resulting in a net credit of 1.58.

As long as XND falls between down 2.52% and up 1.63% the result is a profit equal to the credit received. A partial profit may be realized if XND is 3.61% lower or 2.72% higher at expiration.

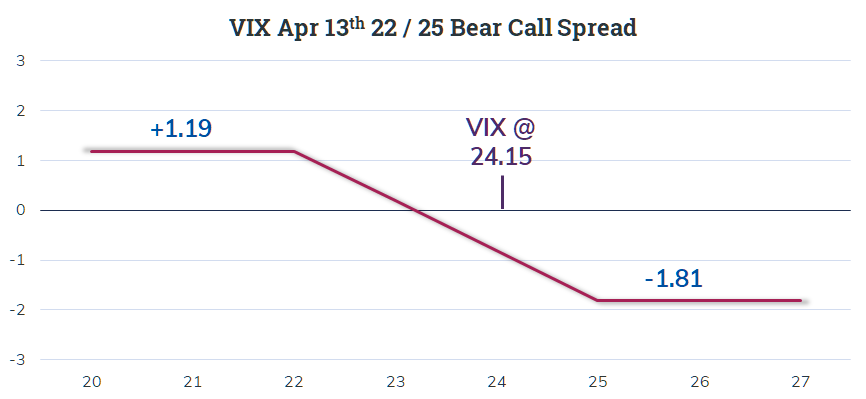

Wednesday last week was the peak for VIX and I came across several VIX option trades using the April 13th expiration which is a non-standard expiration date. One example, with spot VIX at 24.15 a trader sold 500 VIX Apr 13th 22 Calls for 3.05 and bought 500 VIX Apr 13th 25 Calls for 1.86 taking in a credit of 1.19. VIX below 22 at VIX April 13 settlement is the ultimate goal here.

There were multiple other similar trades on Wednesday last week combining short lower strike calls and long higher strike calls focusing on next week’s VIX expiration so several volatility traders believe VIX’s new home is in the low 20’s, at least through the middle of next week.