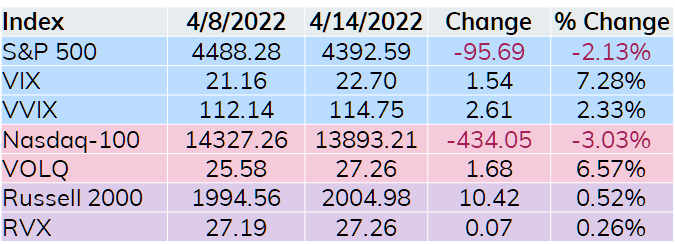

Stocks were mixed last week with the S&P 500 (SPX) and Nasdaq-100 (NDX) losing value and the Russell 2000 (RUT) gaining slightly. All volatility indices were higher, even the Russell 2000 Volatility Index (RVX) by a tad, despite the rise in RUT. Also, long weekends typically provide a headwind to volatility indices, due to the calculation methodology using calendar days, but that does not seem to be a factor regarding this long weekend.

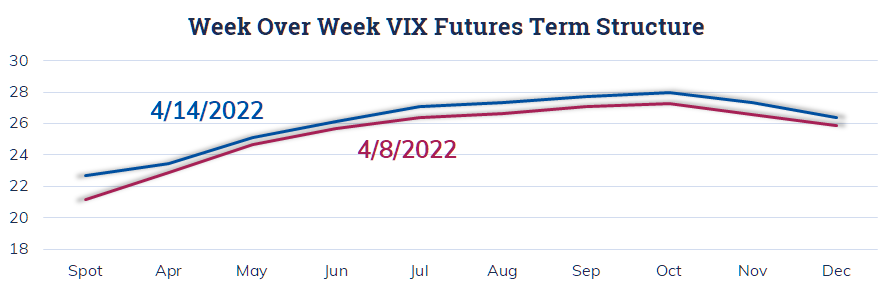

As noted, VIX was a bit higher last week. VIX futures gained value as well, but not to the extent of the gains of spot VIX. One bright spot is that, despite VIX remaining in the 20’s the term structure has remained in contango which will hopefully accompany a bit more normalcy in the equity markets going forward.

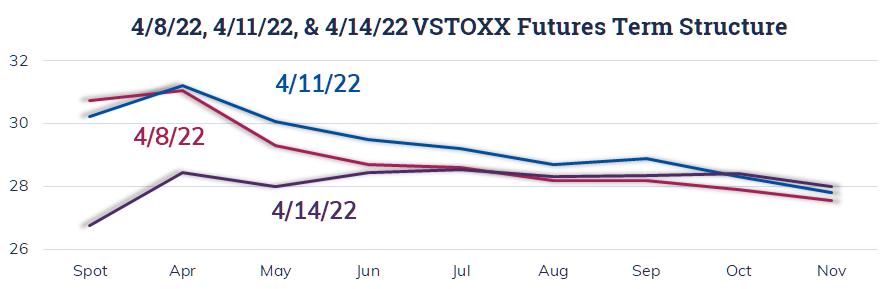

Last weekend the French people went to the polls for the first round of the 2022 election process. The final two candidates are incumbent Emmanuel Macron and Marine Le Pen. The expectation was these would be the two candidates to emerge from round one. However, many pundits noted Le Pen was closer than she had been in the past. This likely contributed to spot VSTOXX remaining at relatively high levels on Monday this past week. The term structure chart below shows Monday’s VSTOXX pricing as well as the week over week term structure changes.

Also note the rise in both the April and May futures contracts between last Friday and Monday, normally after an event implied volatility drops. If the event does not provide clairity or contributes to more uncertainty the result can be expected volatility will remain at high levels which seems to be the reaction to Le Pen possibly having a chance at winning when the French vote again on April 24.

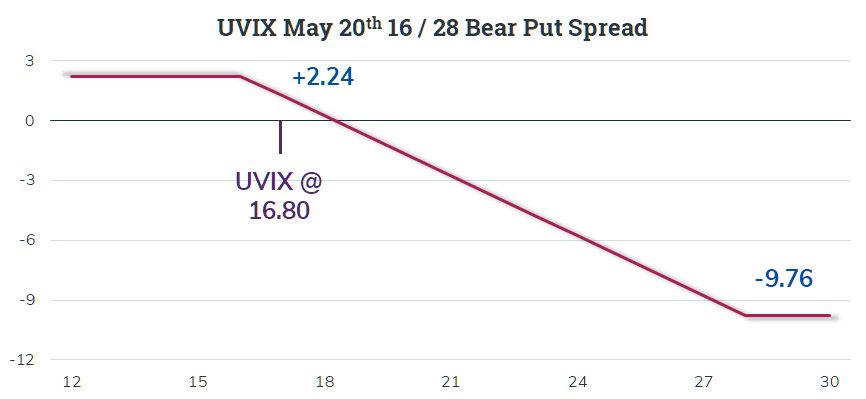

A couple of weeks ago SVIX and UVIX were added to the methods of gaining exposure to expected volatility. SVIX offers short exposure to VIX futures while UVIX is a leveraged long VIX futures ETF. Options are now available and traders are dipping their toe in the water with these two new products. On Monday April 11 with UVIX at 16.80 a trader came in purchasing the UVIX May 20th 28 Put for 13.71 and selling the UVIX May 20th 16 Put for 3.95 and a net cost of 9.76.

Long VIX related exchange trade traded funds have the tendency to drift lower over time and I’m certain that’s the thinking behind this trade.

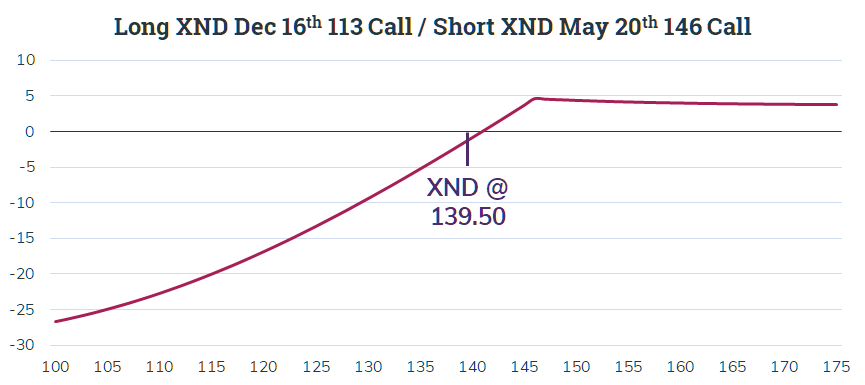

Finally, I came across a Nasdaq-100 Micro Index (XND) trade combining a longer dated long call with a shorter dated short call. On Friday with XND at 139.50 a trader bought the XND Dec 16th 113 Call for 31.45 and sold the XND May 20th 146 Call for a net cost of 30.00. The payoff at May expiration shows up below.

The motivation behind this trade could be one of a number of things. Typically in the past when I’ve done a trade like this I intend on selling more calls against the long position, but I would usually sell something with a shorter time frame than this May call that expires in a month. If the intent is to exit around May expiration, it could be thought of as a leveraged version of a covered call. I plan on keeping an eye on the short May call for any signs of a rolling transaction as expiration approaches.