Buyside Strategies EQD Research Volatility

VOLQ, One-Day Price Moves, And An Edge In Trading NDX Iron Condors

Jun 30, 2020

For good reason, volatility indices have been getting a lot of attention in 2020. So has the Nasdaq-100 (NDX) which has left the other major market indices in the dust this year. The Nasdaq-100 Volatility Index (VOLQ) topped out in the low 70’s during the first half of 2020, a level that was much lower than other measures of expected volatility which may be attributed to the outperformance of NDX.

When volatility indices reach elevated levels, market commentators like to cite what this means in terms of a one-day move. The easy way to do this is divide the volatility index by sixteen, a trick that floor traders used for years. However, the more specific formula to convert VOLQ to a single-day market forecast appears below.

There are typically 252 trading days in a year and the square root of 252 is about 15.87, which is where the sixteen figure comes from for a quick back-of-the-envelop one-day prediction. Many find this figure an interesting number, but I have found it is useful in choosing strikes for one-day option trades, specifically iron condors. Using a volatility index to choose the strike prices of options when putting on an iron condor means the range of maximum profit is wider when the market expects more volatility and narrower when the market is quiet. It also offers insight into how often the underlying market moves more than expected, at least based on the adjusted level of the associated volatility index.

For example, on April 7, VOLQ closed at 40.61. Using the formula above, this translates into a one-day move for NDX of up or down by 2.56%. April 7 was a Tuesday and if a trader felt the market would not move up or down by more than 2.56% on April 8, they could construct an iron condor to take advantage of this forecast using NDX options that expire on Wednesday, April 8.

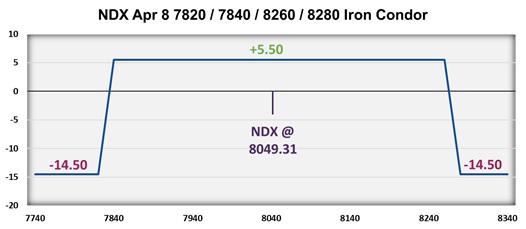

The first step to trading an iron condor is to choose the short strikes for the spread. If the 2.56% prediction calculated above is combined with the NDX closing of 8049.31 the result is 205.92. This means a 2.56% move up would has NDX close the following day at 8255.22 and a 2.56 drop results in NDX closing at 7843.39. The closest strike prices to these levels are the 8260 call to the upside and 7840 put on the downside. To complete the spread, and define risk, the 8280 call and 7820 put would be purchased. In this case the spread could be initiated for a credit of 5.50 which means the risk for the trade is 14.50. A payoff at expiration, which is the following day, appears below.

This trade realizes a maximum profit if NDX does not fall outside a range of 7840 to 8260. The following day NDX was higher by 2.24% closing at 8229.54. The result is the best-case scenario where all options expire out of the money and the profit for the trade is equal to the 4.50 credit taken in with the trade was initiated.

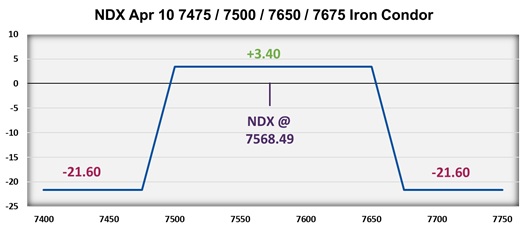

A second example is created using pricing from April 9, 2019, which was also a Tuesday and basically the same week as the first example. VOLQ was much lower, finishing the day at 16.01. This implies a market forecast the following day of a move higher or lower by 1.01%. NDX closed at 7568.49, therefore the upside call strike to sell would be near 7644.84 and the downside put strike would be close to 7492.14. This is much narrower than the first example where VOLQ closed at 38.38. The April 10 NDX strikes were offered in increments of 25 points so the 7650 call and 7500 put would be sold. To complete the iron condor the 7675 call and 7475 put would be purchased. The net result for this trade is a credit of 3.40 and a maximum loss of 21.60. A payoff based on closing prices on April 10, 2019 appears below.

The day after this iron condor was priced out, NDX rose 0.57% to close at 7611.49, much less than the 1.01% market prediction. Once again, all options in the spread expired with no value and the credit received when the spread was initiated turns into a profit.

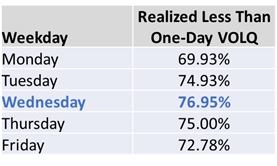

The title of this piece mentions an ‘edge’ which is what traders are always seeking. Using VOLQ data going back to the first day of 2014 through June 26, 2020 we found that the one-day price change for NDX falls within the predicted one-day range 73.99% of trading days. If a trader has the ability to implement an iron condor with one-day options they would expect all options in the spread to expire with no value just under three out of four trades. However, NDX options expire on Monday, Wednesday, and Friday (with the third Friday being an AM settlement). The two most consistent strategies would involve trading on Friday using the following Monday options or on Tuesday using the options expiring on Wednesday. Being that there is a day of the week issue we took a look at the following day’s market move versus what is predicted by VOLQ by day of the week. The percent of observations where NDX moved less than predicted by VOLQ by day of the week appears in the table below.

It turns out that Wednesday, which is highlighted above, is the day of the week where the NDX price move most often falls within the range predicted by converting VOLQ to a one day move. This also means trading an iron condor on Tuesday, using the following day options, would result in a profitable trade almost 77% of the time. We took things a step further and tested this using data from January 2019 through June 2020. The result was sixty out of seventy-five observations (80%) and over 80 points of profits. Most of the profits came in 2019, but the wider strikes and higher option premiums in 2020 resulted in a small profit over the first six months of this year. Although not terribly impressive for 2020, very few consistent neutral market strategies can claim to have put up profits in 2020.

There are lots of moving parts here, so a brief summary is in order.

- VOLQ may be converted to the market’s prediction of a one-day price move for NDX

- This is useful in choosing strike prices for neutral trades like iron condors

- Wednesday is the day of the week when VOLQ is most likely overstating the subsequent move in NDX

- Trading on Tuesday with one-day Wednesday NDX options may offer a slight edge for iron condor traders