Buyside Strategies EQD Research Volatility

Following Up on VOLQ, NDX, And Choosing Strikes

Jul 13, 2020

Recently I wrote a piece discussing how implied volatility may be used to choose strikes when creating a market neutral option trade: VOLQ, One-Day Price Moves, And An Edge In Trading NDX Iron Condors. In that article I noted that NDX Wednesday price changes fall within the previous day’s prediction of a one-day move as calculated by adjusting VOLQ to calculate a one standard deviation, one-day price change for NDX. The result was from 2014 through the first six months of 2020 that the one-day price change on Wednesday for NDX falls into an up or down one standard deviation prediction 76.95% of trading days. I also pointed out that consistently putting on a one-day iron condor on Tuesdays using options expiring the following day would have returned 80 points of profit between January 2019 and June 2020.

I received a few emails asking about the trading implications of this. Basically, the one-day price change predicted is a one standard deviation price change. We all remember from statistics that a price change that falls between up and down one standard deviation should happen 68.2% of observations. If price changes fall between up and down one standard deviation more often than 68.2% of the time then there may be an opportunity to systematically profit from the difference between what option prices are predicting and subsequent market activity. It turns out a consistent one-day iron condor or short strangle that uses VOLQ to determine the options to sell short would have done pretty well over the past 18 months.

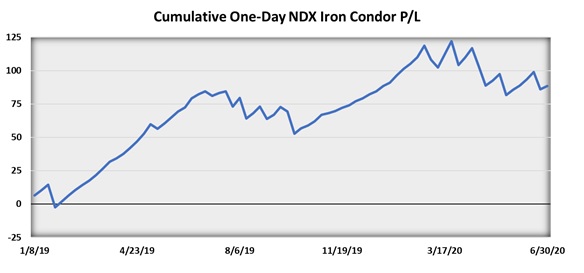

In last week’s write up I gave a couple of examples of NDX iron condors that could be traded on Tuesday afternoon and held through Wednesday’s close. From January 2019 to June 2020 there were seventy-six opportunities to enter a one-day trade using Wednesday NDX. Sixty-one of those observations resulted in a profitable trade. I ran a quick test on how consistently trading an iron condor with NDX options and using VOLQ to determine the short strikes and buying twenty or twenty-five point (depending on available strikes) out of the money NDX puts and calls to complete the trade worked over the last year and a half. Following that basic strategy results in a win percentage of just over 80% and a cumulative profit of 88.56 points. The following chart shows a hypothetical cumulative profit and loss chart based on consistently following this approach.

Data Source: Bloomberg and EQDerivatives Calculations

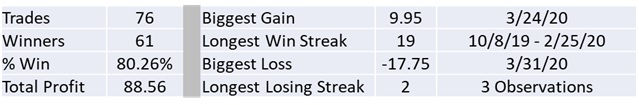

A few other important statistics show up in the table below with respect to this approach to a short-term iron condor approach. The largest gain occurred in 2020 as did the biggest loss. In fact, they occurred in consecutive weeks. The longest win streak was nineteen weeks running from October 2019 through February 2020. The longest losing streak was two weeks, which came in October 2019, March 2020 and April 2020. The biggest single trade loss was -17.75 points.

Data Source: Bloomberg and EQDerivatives Calculations

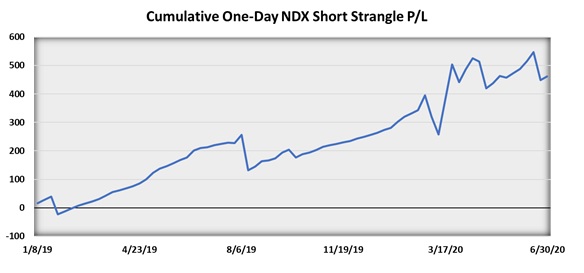

I received another inquiry regarding the previous article asking how a short strangle would work based on the same idea that was behind the one-day iron condor. I personally, along with most traders, prefer to know the worst-case result for an option trade. A short strangle opens a trader up to significant risk, so this is not appropriate for everyone. It turns out selling a one-day strangle on a Tuesday, using VOLQ to determine the strikes, and holding through expiration on Wednesday results in a cumulative profit of 461.71 points which shows up in the chart below.

Data Source: Bloomberg and EQDerivatives Calculations

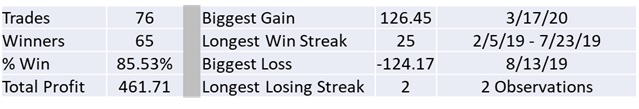

A final table shows some statistics associated with consistently selling an NDX strangle. I found the differences between these figures and the results for the iron condor interesting. For example, the win rate is higher, at 85.53%, which is a function of there being a wider range for a potential profit when using a strangle versus an iron condor. The biggest loss of 127.17 points is not a surprise, however, I would not have guessed the biggest loss would have occurred in 2020, but it was actually in August 2019. In August 2019, VOLQ was in the mid-teens which resulted in a pretty narrow range between the put and call strike in the spread, while the one-day price move (-139.87) was dramatic. The longest win streak differs from that of the iron condor running twenty-five weeks from February 2019 to July 2019. Finally, for the strangle, there were only two losing streaks of two weeks that occurred in March 2020 and April 2020.

Data Source: Bloomberg and EQDerivatives Calculations

Although the short strangle is attractive from the total profit and win rate results, the large single loss of 124.17 points is worth highlighting again. Also, in March 2020, where there were two consecutive losses, the combined total was substantial at 136.41 points. The strangle approach is not for traders who cannot weather these sorts of downside moves.

Both the iron condor and short strangle are attractive approaches when option pricing differs from a market forecast. It appears combining NDX option prices with VOLQ to set the strike prices may be a logical approach to trading these neutral spreads. This follow-up is a direct response to inquiries I received about the first article looking at VOLQ and NDX, please feel free to email me at rhoads@eqderivatives.com with comments or questions.