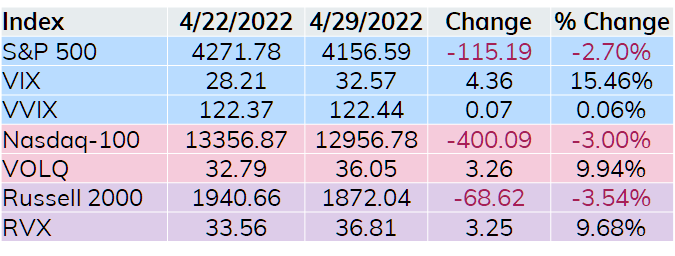

The markets continued grinding lower last week with all the major indices losing more than 2% and the Nasdaq-100 dropping more than 3% for the fourth consecutive week. VIX closed above 30.00 for the first time since early March this past week doing so three of five trading days.

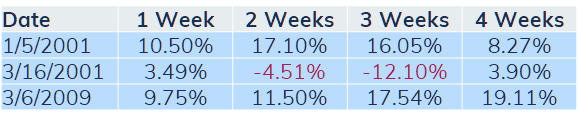

As noted above, NDX has lost more than 3% the past four weeks, something that has not happened frequently in the past. This was only the fourth time since 2000 and the last time was in March 2009. The week following the fourth down 3% week was spectacular for NDX with a gain of over 10%. The table below shows the 1, 2, 3, and 4-week performance for the NDX after these 3% losing streaks.

As noted above, NDX has lost more than 3% the past four weeks, something that has not happened frequently in the past. This was only the fourth time since 2000 and the last time was in March 2009. The week following the fourth down 3% week was spectacular for NDX with a gain of over 10%. The table below shows the 1, 2, 3, and 4-week performance for the NDX after these 3% losing streaks.

There were two instances in 2001 of four 3% plus weekly losses and in both cases NDX rose the following week. In March 2001, the first week was a solid rebound, but there was a resumption of the downtrend before another rebound to make the four-week performance turn to the positive. Finally, in 2009, NDX also rebounded with a stellar week rising 9.75% and gaining almost 20% over a four-week window.

There were two instances in 2001 of four 3% plus weekly losses and in both cases NDX rose the following week. In March 2001, the first week was a solid rebound, but there was a resumption of the downtrend before another rebound to make the four-week performance turn to the positive. Finally, in 2009, NDX also rebounded with a stellar week rising 9.75% and gaining almost 20% over a four-week window.

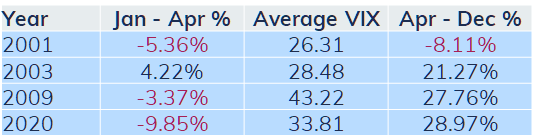

Another indicator may be a bit bullish for stocks through the rest of 2022. The average VIX close so far in 2022 is 25.13. Only the fifth time since 2000 that VIX has averaged over 25 through the first four months of a year. The other observations show up in the table below.

The last three times VIX averaged over 25.00, the following eight months resulted in gains of over 20%. The most distant observation was 2001, a year that experienced the popping of the internet bubble from the late 90’s.

The VIX curve inverted a bit this past week after finishing the previous week flat. Stock bulls may find the backwardation encouraging with the futures expecting VIX to recede a bit.

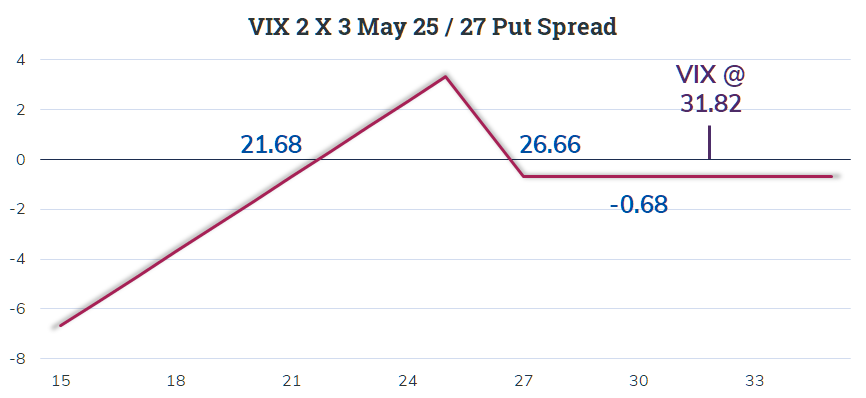

One trade is expecting VIX to return to the mid-20’s over the next couple of weeks. On Wednesday, with VIX at 31.82, a trader bought 20,000 VIX May 27 Puts for 2.02 and sold 30,000 VIX May 25 Puts for 1.12. The net for each 2 x 3 spread is a net cost of 0.68 and a payoff at expiration in the diagram below.

Between 21.68 and 26.66 the trade will realize a profit, a level that VIX seems to like to hover around in 2022. Also, if a potential bounce in equity prices occurs, like it has historically after the figures shared above, this is a good way to play it.