Enjoying the Saturday Review? After August 1 it will become a part of our EQD+ bundle. Subscribe today for continued access: http://armanios.co.uk/dev/eqd/become-a-member

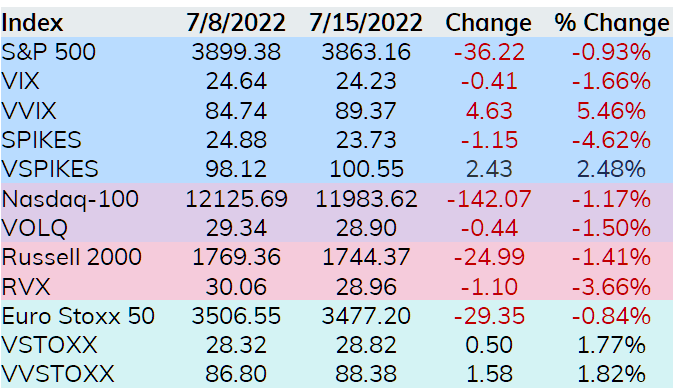

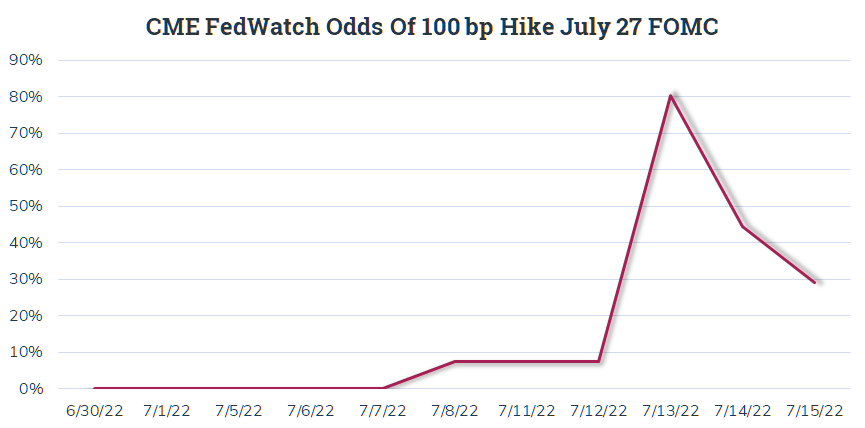

We got the worst CPI number in decades and the S&P 500 loses a little less than 1% on the week. This despite a quick shift in the odds of a 100 basis point hike at the July 27 FOMC meeting, which reverted back to market pricing in a 75 basis point hike at the end of July. To top things off VIX was lower on a week over week basis.

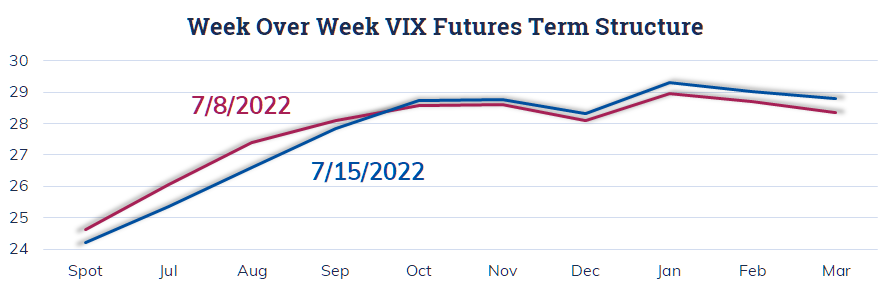

As noted above, VIX was down on the week, and the nearer dated futures followed spot. The longer dated futures rose a bit. This price action creates the ‘twist’ seen below.

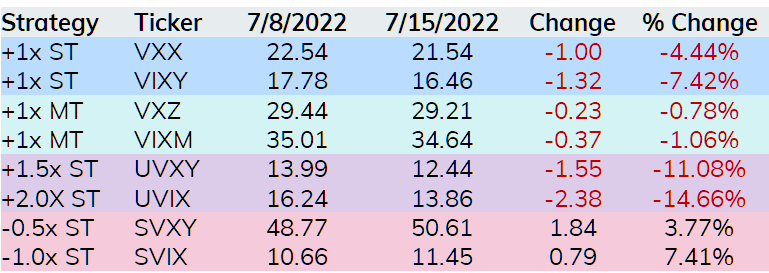

With a drop in the near dated futures, combined with the VIX term structure remaining in contango each day last week, the long short dated VIX ETPs were under pressure while the short funds had their day in the sun. SVIX was the big winner on the week, gaining over 7% while UVIX which offers two times leveraged long exposure to the front two month VIX futures contracts lost almost 15%.

After Wednesday’s CPI there was much discussion around the next Fed move being a hike of 100 basis points. When there is talk around Fed action we turn to the CME FedWatch tool (www.cmegroup.com/fedwatch) to see what the market thinks. The market had adjusted to signal over an 80% chance that the next FOMC move would be to increase rates by 1.00%. However, by the end of the week, those odds have moved below 30%. As the next meeting approaches, we will definitely be checking the CME’s site to see what Mr. Market is thinking.

Before jumping into new trades, we want to follow up a bit on an XND (1/100 of NDX) collar we wrote up last week. On Friday July 8, a trader sold 100 XND Jul 15 123 Calls for 1.01 and purchased 100 XND Jul 15 119 Puts for 1.01 for no cost excluding fees. The trade was looking smart on Monday morning and it appears they rolled this collar into a bear put spread, combined with a portfolio that tracks XND would offer downside protection between 119 and 114 for transaction costs. They acheived this buy selling the XND Jul 15 114 Put for 0.41 and covering the short XND Jul 15 123 Call position that was initated on Friday.

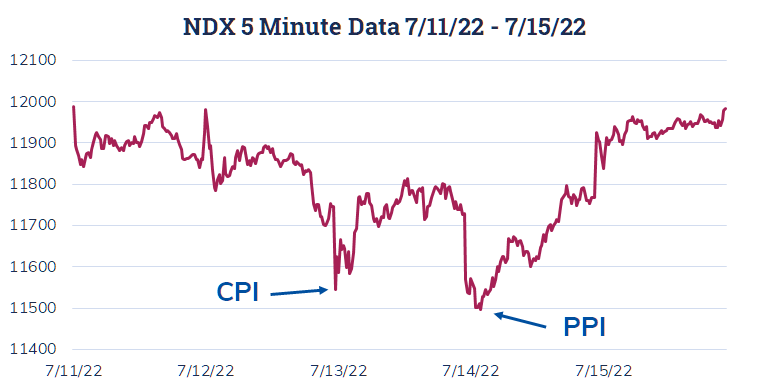

Last week CPI and PPI offered up a couple of short term buying opportunities. The chart below uses 5-minute NDX data to shows what we mean by this.

The open on Wednesday (CPI) and Thursday (PPI) are highlighted. Note there is very little price action below these two levels, although the PPI reaction tested slightly lower prices.

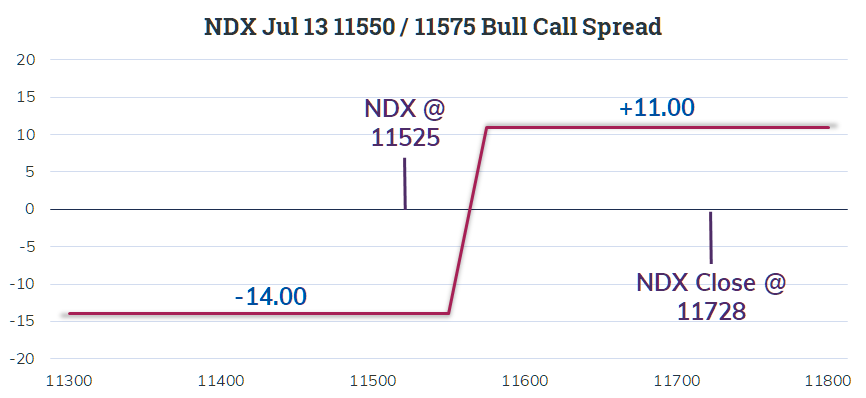

On Wednesday a couple of bullish NDX vertical spreads hit the tape just after the opening bell. Both were execurted with NDX around 11525 and the first purchased the NDX Jul 13 11550 Call for 74.50 and sold the NDX Jul 13 11575 Call for 60.50 for a net cost of 14.00 and a potential return of 11.00. The payoff on the close shows up below.

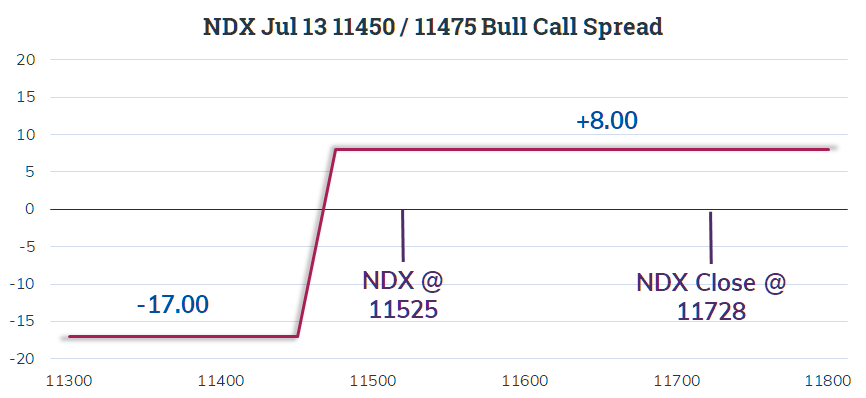

The second trade occurred just seconds later with NDX still around 11525. This second trade was a bit less aggressive buying the NDX Jul 13 11450 Call for 126.95 and selling the NDX Jul 13 11475 Call for 109.95 and a net cost of 17.00. The best outcome for this trade is a profit of 8.00 as seen below.

Both trades stepped in front of a pretty negative market reaction which is often referred to as catching a falling knife. Using options allows a trader to catch a falling knife, but wearing gloves that limits the potential damage if things do go a trader’s way.