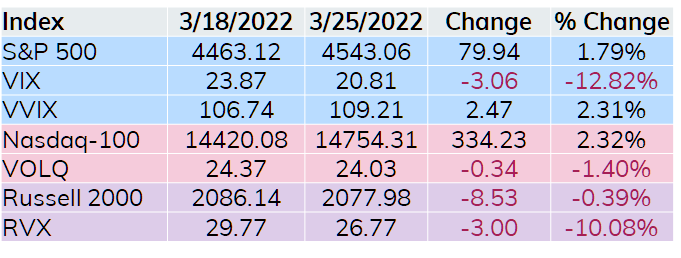

Stocks were mixed last week with the S&P 500 and Nasdaq-100 gaining ground and Russell 2000 dropping slightly. Volatility index performance varied as well with VVIX moving up a bit, but the other three indices losing value. RVX dropped a significant amount considering the Russell 2000 lost value last week as well.

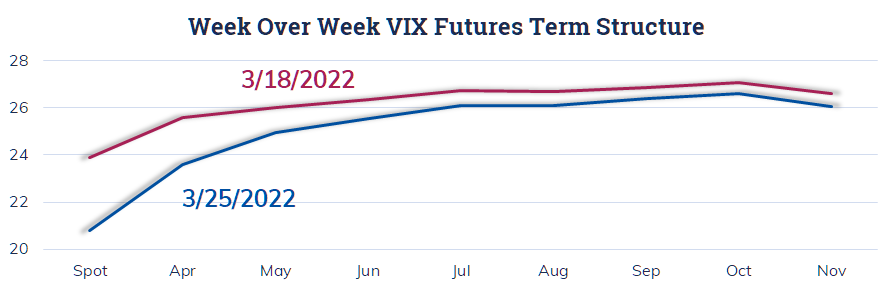

The VIX term structure uniformly moved lower with VIX approaching the upper teens last week. It has been a while since we’ve seen a nice parallel move for the VIX curve.

Despite VIX approaching 20, the front month April future is at about a 3 point premium relative to spot VIX. The curve shape is normal, but the wide spread for the future versus spot indicates traders are still on edge with respect to the financial markets.

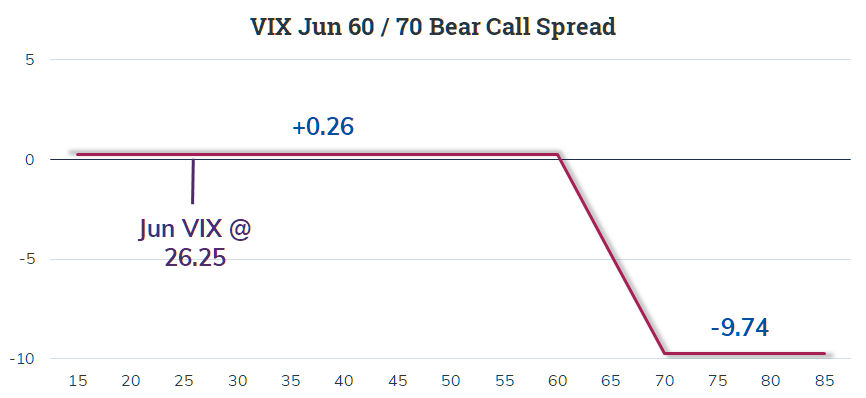

On Tuesday, one trader took a large position assuming that VIX will not move over 60.00 between now and mid-June. With the June VIX future at 26.25 there was a seller of 81,350 VIX Jun 60 Calls for 0.99 who purchased the VIX Jun 70 Calls for 0.73 taking in a credit of 0.26.

The reward versus risk for this trade may not be attractive to all traders, but alot has to go wrong for this trade to realize the maximum loss of 9.74.

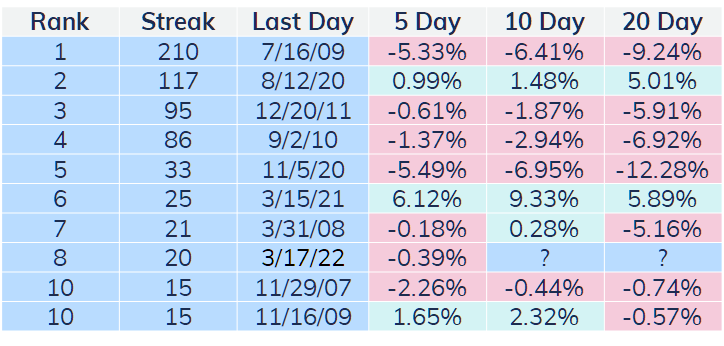

Last week, I wrote about Russell 2000 performance following a streak where the Russell 2000 Volatility Index (RVX) was over 30 for fifteen days or longer and then closed under that level. The results were less than bullish when looking at 5, 10, and 20 days following the end of the RVX greater than 30.00 streak. The table below is an update showing the 5-day period was as slight loser (0.39%), which matches up with the majority of observations.

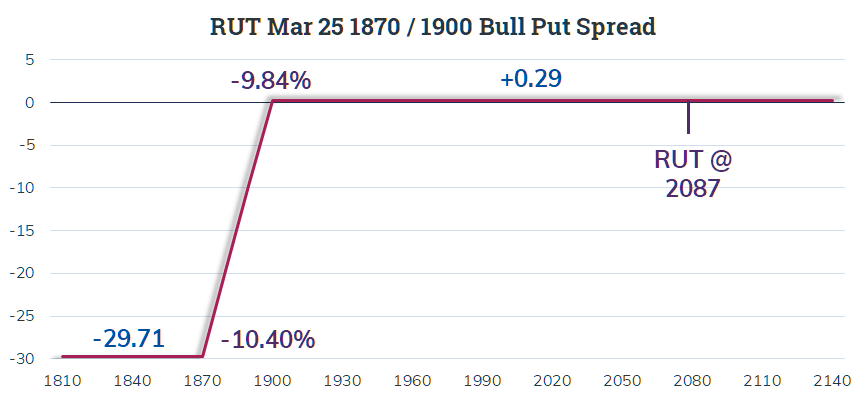

On Monday, less than a minute into the trading week, one trader used RUT options to speculate that the small cap benchmark would remain over 1900 through Friday, Mar 25. With RUT at 2087, the trader sold almost 800 RUT Mar 25 1900 Puts for 1.50 and purchased the same number of RUT Mar 25 1870 Puts for 1.29.

Note that this trade risks 29.71 for a profit of only 0.29. However, looking back over decades of Russell 2000 performance history, there have been only 13 weeks where RUT lost more than 10% in a week or 0.72% of observations. This sort of risk reward makes sense relative to an outlier event like a drop of 10%.

The reason I say this risk / reward is favorable relates to the historical outcome for similar trades. Consider that roughly 0.72% of weeks this trade would lose the maximum of 29.71. Another way to think about this is 7.2 times for each 1000 trades we would lose 29.71 while 992.8 times we would make the maximum profit of 0.29. The result, again overly simplifying the outcome as a binary event, would be losses of $213.91 (7.2 x 29.71) more than offset by a gain of $287.91 (992.8 x 0.29).

Although this historical overview of how this trade would have worked over the years would not do this trader much good if RUT had dropped dramatically last week, option traders do compare what the market is pricing in versus their outlook or history. This is a prime example of how a trade makes sense when the risk / reward compares favorably to history, even if the dollar loss is mulitples of the dollar gain.

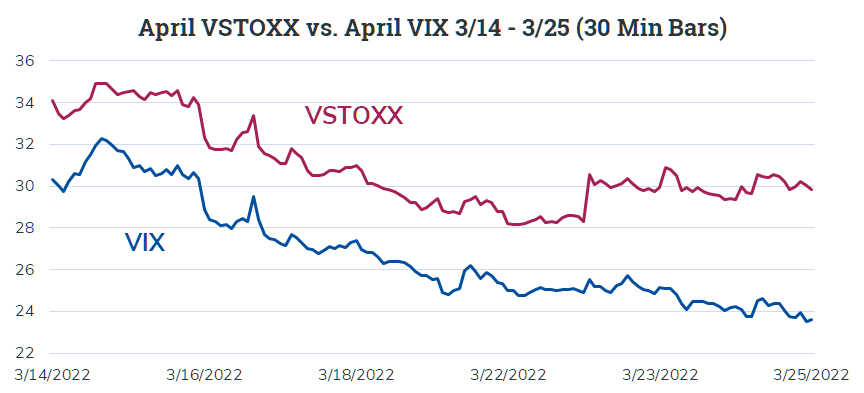

Finally, turning to Europe, we do have what has historically been a potential European volatility event in the form of the upcoming French election with round one scheduled for April 10. I believe this pending event is showing up in the spread between the April VSTOXX and April VIX future pricing. The following chart uses 30-minute prices over the past two weeks for both futures markets during regular US stock market hours.

On March 14, the April VSTOXX contract priced in a 3.80 premium to April VIX. This spread widened to 6.25 by the end of last week. Expect this premium to hold up and probably widen a bit more over the next couple of weeks. Then, depending on the outcome of the April 10 election, revert to a narrower range or possibly widen if the outcome is concerning to the financial markets.

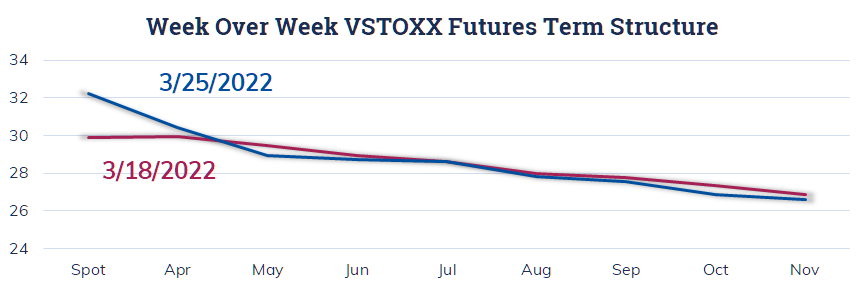

The anticipation of the election a couple of weeks out also showed up in the VSTOXX curve, which unlike VIX, is still in backwardation. This is another state of the markets that should not change until after the French election results are digested by the markets.