Last week the S&P 500 got as low as 3858.87, down 19.6% from the all-time high last year. This is so close to the magical down 20% level that the business networks likely had all kinds of graphics ready to go and maybe even a “Bear Market Special” ready for broadcast. However, buyers came in, possibly front running the dip buyers that were waiting patiently for the full 20% drop from the high. Maybe so many traders tried to get ahead of the full 20% drop that we just never got it.

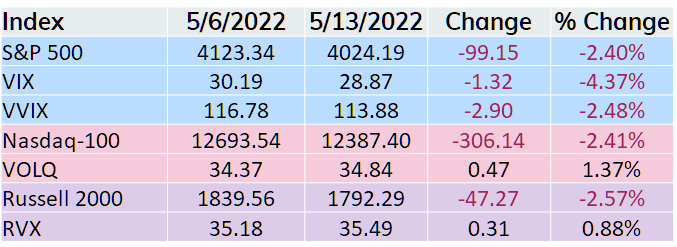

The week did not feel as bearish as it turned out. Despite SPX, RUT, and NDX all dropping around 2.5% for the week, Friday’s price action was strong enough to give the bulls something to cheer about or at least not worry too much over the weekend. The S&P finished the week 4.3% higher than the intraday low on Thursday, the Russell 2000 finished 5.4% off the lows and the Nasdaq-100 was 5.9% better than the Thursday low. Time will tell us if this is just a bear market rally or the beginning of a turn to the upside.

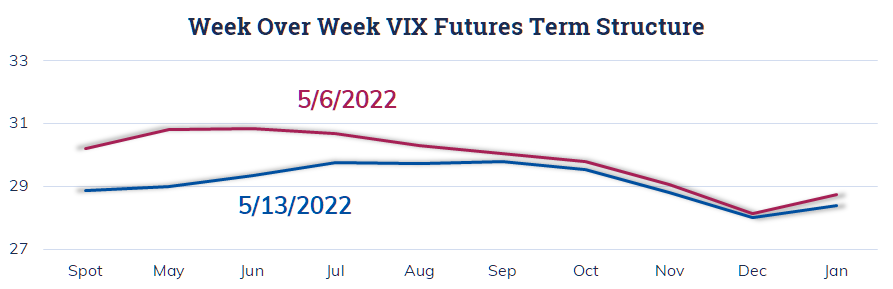

The VIX term structure fell, mostly due to price action on Friday, back into contango on the short end of the curve. May expiration approaching contributed to this as well as June takes over as the front month this coming week.

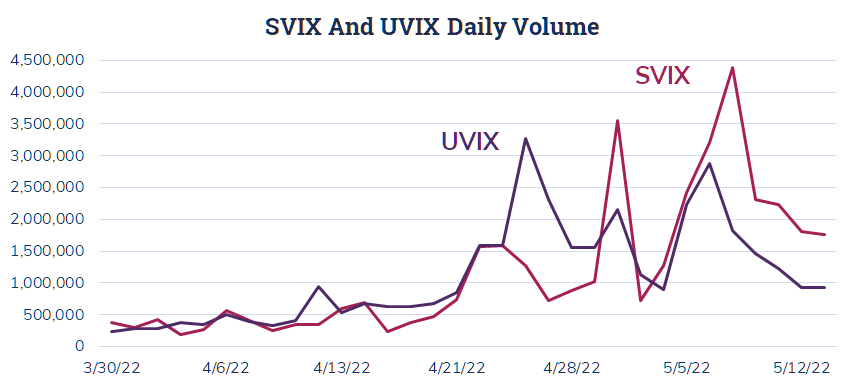

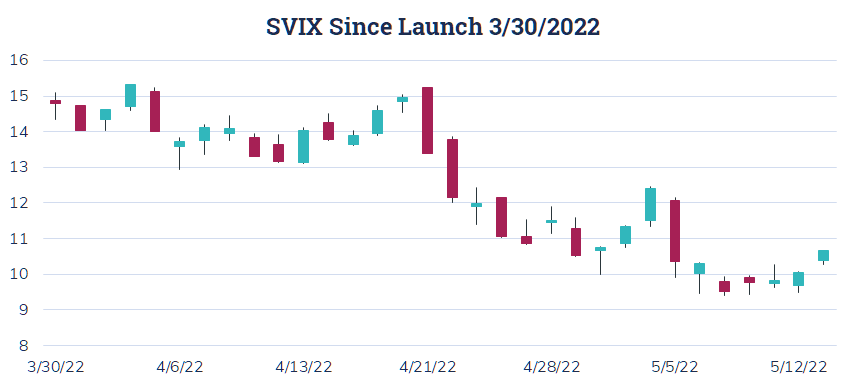

In late March, Volatility Shares launched two VIX related ETFs. The -1X Short VIX Futures (SVIX) and 2X Long VIX Futures (UVIX) ETFs premiered with solid volume and that figure has steadily increased for both funds.

After a slow start, trading under 500,000 shares each day for the first couple of weeks, both are now consistently trading over a million shares a day with SVIX putting up a very impressive 4.4 million shares this past Monday. This strong volume accompanied the all-time closing low for SVIX.

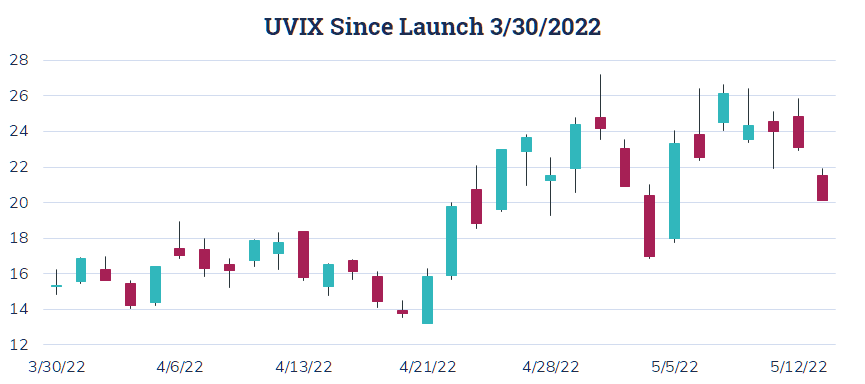

Performance wise, UVIX struggled a bit for the first couple of weeks due to choppy price action in VIX futures. In late April, as VIX rose and the futures followed, UVIX took off to the upside, rising about 57% in less than two weeks.

Long volatility ETPs receive a lot of criticism due to the performance drag that occurs when VIX futures are in contango. However, a really smart guy at Cboe once said, “The long volatility ETPs do what they are supposed to do when they are supposed to do it”, and the quick move higher in the middle of the chart above is a prime example of UVIX offering an opportunity to benefit from a rise in volatility.

The short volatility trade has been a tough one in 2022, especially in the past few weeks. Through April the Cboe Eurekahedge Short Volatility Hedge Fund Index is down 2.26% for 2022. This environment has put pressure on SVIX for most of its short life.

As expected, SVIX came under pressure at the same time UVIX took off to the upside, but the fund started to move off the lows this past week. As noted above, SVIX volume was very strong this past week, possibly reflecting a wider view that taking advantage of the volatility risk premium as well as the structure of SVIX is a strategy worth considering.

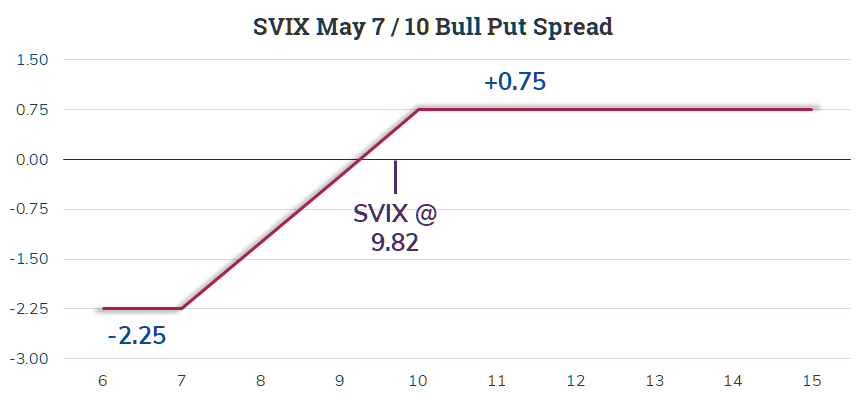

It is easier to get a read on option trades than volume in the delta one market so I did some digging into SVIX option trades from this past Monday. There are not weekly options available for SVIX, but this coming week is a standard third Friday expiration week. When SVIX was at 9.82 a trader sold the SVIX May 10 Puts for 0.85 and bought the SVIX May 7 Puts for 0.10 netting a credit of 0.75. This trade just needs SVIX to close over 10.00 this Friday to realize the maximum 0.75 profit.

Another Monday trade, focusing on a longer time frame, consisted of purchasing the SVIX Sep 10 Calls for 2.00 when SVIX was at 9.68. Those options rose to 2.40 by the end of the week with over 200 trading on Friday and almost all the volume appearing to be bullish on SVIX and by default bearish on VIX.