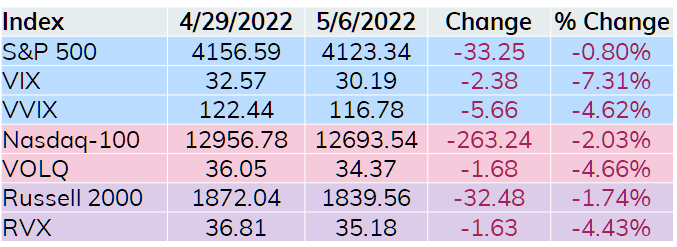

I have been following equity derivative and volatility markets for over a decade. In all that time, I cannot recall an instance where broad based indices and their related volatility indices were all lower on a week over week basis. However, that is what we got last week.

Before moving forward, an admission that some stats I threw out there last weekend did not turn out as I had hoped. Specifically, I noted that since 2000, NDX had only three streaks of 3.00% or greater losses four weeks in a row. After each of those losing streaks NDX put a very solid week. Needless to say, I was feeling pretty good about myself until things to a turn to the downside on Thursday.

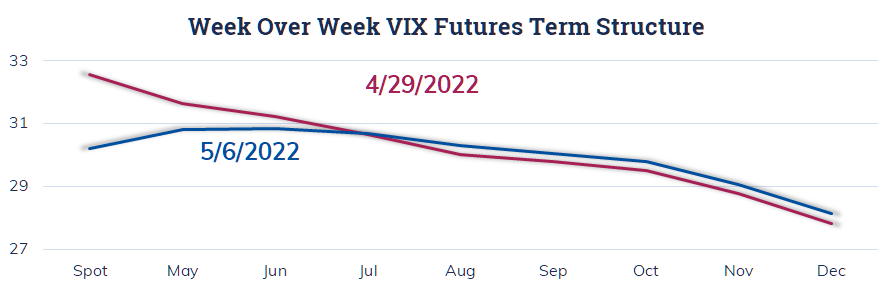

The VIX curve flattened toward the end of the week and spot VIX through the September future all finished with a 30 handle. The flat curve indicates uncertainty (something I think I have written in this space multiple times in the past few months) which is probably a good indication of the mind of the market these days.

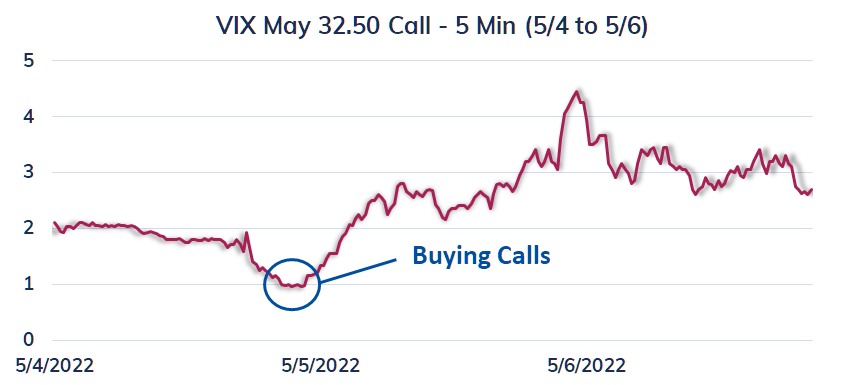

In the VIX option space there was a nice end of day trade on Wednesday that faded the rise in equity prices and the drop in VIX. With minutes remaining in the day there was a buyer of about 3,000 VIX May 32.50 Calls paying 1.05 in a handful of lots.

Instead of the normal payoff diagram, I decided to dig out 5-minute data on this option. The timing of this trade may be as perfect as it gets, with the execution at the end of the day Wednesday. Buying on a dip in any market may be difficult, however, I think this trade shows why options are so effective as trading tools. The worst-case scenario is if VIX continued the downtrend that commenced in response to the Fed announcement. But the loss would be 1.05 and knowing that would make holding on to this position palatable if VIX continued lower the following day.

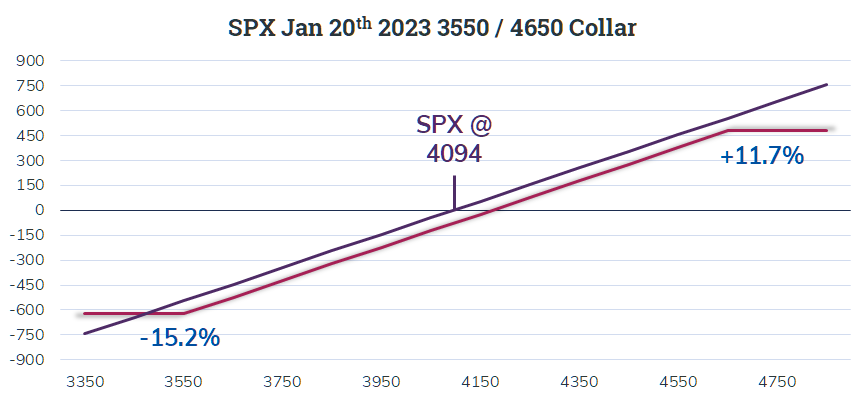

Turning to the S&P 500, mid-morning Friday with the S&P 500 at 4094, on trader sold 6375 SPX Jan 20th ’23 4650 Calls for 96.00 each and purchased the same number of SPX Jan 20th ’23 3550 Puts for 174.00 resulting in a net cost of 78.00. It appears this was the biggest part of a collar using 7500 contracts which comes to about $3 billion in equity exposure. My assumption is this is a collar with the notional value of just over $3 billion in equity exposure. The collar cost gives up 1.9% of any 2022 performance.

The collar caps upside performance at 11.7% with downside performance hedged 15.2% lower. The cost of this collar versus not getting any protection against a downside move for over 15% makes me pause, but I’ll assume a manager with $3 billion of equity exposure knows what they are doing.

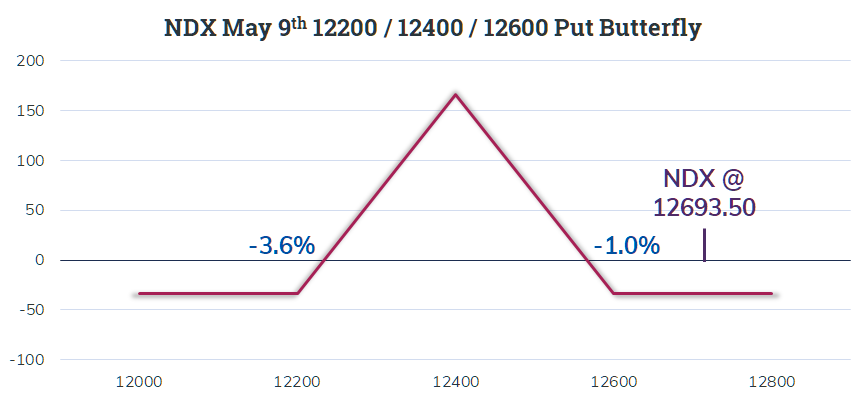

Finally, at the other end of the time spectrum, a trader came into the NDX option market with about 2 minutes left in the trading day predicting where NDX should finish on Monday. With NDX at 12,693.50 a trader bought 5 NDX May 9th 12600 Puts for 108.32, sold 10 NDX May 9th 12400 Puts for 46.56, and then finished out a put butterfly buying 5 of the NDX May 9th 12200 Puts for 18.30. The result is a cost of 33.50 per spread.

The prediction for NDX is to drop between 1.0% and 3.6% on Monday with a closing level of 12,400 being ideal resulting in a profit of 166.50 per spread.

Finally, conference season is upon us at EQDerivatives, with our European conference in Barcelona on May 16 and 17. The European conference is followed by a quick turnaround with our Global conference in Las Vegas on May 25 and 26. I will be at both events and if you have suggestions for this space or anything else I can do better, please feel free to share your thoughts.

Europe EQD 2022 – http://armanios.co.uk/dev/eqd/events/europe-eqd-2022

Global EQD 2022 – http://armanios.co.uk/dev/eqd/events/global-eqd-2022